How to Calculate Your Mortgage Payment

Calculating mortgage payments is complicated, but Rezzy's Mortgage Calculator makes it easy.

First, next to the space labeled "Purchase Price", enter the price (if you're buying) or the current value of your home (if you're refinancing).

In the "Down Payment" section, type in the amount of your down payment (if you're buying) or the amount of equity you have (if you're refinancing). A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. Enter this as a dollar amount.

Next, you'll see “Term”. Usually, this is 30 years, but maybe 20, 15 or 10 — and our calculator adjusts the repayment schedule.

Finally, in the "Interest Rate" box, enter the rate you expect to pay. Our calculator defaults to the current average rate, but you can adjust the percentage. Your rate will vary depending on whether you’re buying or refinancing.

As you enter these figures, a new amount for principal and interest will appear below. Rezzy's calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts or even ignore them as you're shopping for a loan — those costs might be rolled into your escrow payment, but they don't affect your principal and interest as you explore your options.

Costs Normally in Your Mortgage Payment

The major part of your mortgage payment is the principal and the interest. The principal is the amount you borrowed, while the interest is the sum you pay the lender for borrowing it. Your lender also might collect an extra amount every month to put into escrow, money that the lender (or servicer) then typically pays directly to the local property tax collector and to your insurance carrier.

Principal: This is the amount you borrowed from the lender.

Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, you'll have an additional policy, and if you're in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it's due.

Mortgage insurance: If your down payment is less than 20 percent of the home's purchase price, you'll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

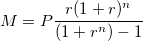

Mortgage Payment Formula

Equation for mortgage payments

Symbol

| M | the total monthly mortgage payment |

| P | the principal loan amount |

| r | your monthly interest rate Lenders provide you an annual rate so you’ll need to divide that figure by 12 (the number of months in a year) to get the monthly rate. If your interest rate is 5 percent, your monthly rate would be 0.004167 (0.05/12=0.004167). |

| n | number of payments over the loan’s lifetime Multiply the number of years in your loan term by 12 (the number of months in a year) to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments (30x12=360). |

How a Mortgage Calculator Can Help

Deciding How Much House You Can Afford

How to Lower Your Monthly Mortgage Payment

- Choose a longer loan. With a longer term, your payment will be lower (but you'll pay more interest over the life of the loan).

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more (or in the case of a refi, equity of 20 percent or more) gets you off the hook for private mortgage insurance (PMI).

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

Next Steps

A mortgage calculator is a springboard to helping you estimate your monthly mortgage payment and understand what it includes. Your next step after exploring the numbers:

Get pre-approved by a mortgage lender. If you're shopping for a home, this is a must.

Apply for a mortgage. After a lender has vetted your employment, income, credit and finances, you'll have a better idea how much you can borrow. You'll also have a clearer idea of how much money you'll need to bring to the closing table.

Mortgage Calculator: Alternative Uses

Planning to pay off your mortgage early.

Use the "Extra payments" functionality of Rezzy's mortgage calculator to find out how you can shorten your term and save more over the long-run by paying extra money toward your loan's principal. You can make these extra payments monthly, annually or even just one time.

To calculate the savings, click the "Amortization / Payment Schedule" link and enter a hypothetical amount into one of the payment categories (monthly, yearly or one-time), then click "Apply Extra Payments" to see how much interest you'll end up paying and your new payoff date.Decide if an ARM is worth the risk.

The lower initial interest rate of an adjustable-rate mortgage, or ARM, can be tempting. While an ARM may be appropriate for some borrowers, others may find that the lower initial interest rate won't cut their monthly payments as much as they think.

To get an idea of how much you'll really save initially, try entering the ARM interest rate into the mortgage calculator, leaving the term as 30 years. Then, compare those payments to the payments you get when you enter the rate for a conventional 30-year fixed mortgage. Doing so may confirm your initial hopes about the benefits of an ARM -- or give you a reality check about whether the potential pluses of an ARM really outweigh the risks.Find out when to get rid of private mortgage insurance.

You can use the mortgage calculator to determine when you'll have 20 percent equity in your home. That's the magic number for requesting that a lender waive its private mortgage insurance requirement. If you put less than 20 percent down when you purchased the home, you'll need to pay an extra fee every month on top of your regular mortgage payment to offset the lender's risk. Once you have 20 percent equity, that fee goes away, which means more money in your pocket.

Terms Explained

Using an online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. It can also show you the total amount of interest you"ll pay over the life of your mortgage. To use this calculator, you"ll need the following information:

Home price - This is the dollar amount you expect to pay for a home.

Down payment - The down payment is money you give to the home's seller. At least 20 percent down typically lets you avoid mortgage insurance.

Loan amount - If you're getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home's price. If you're refinancing, this number will be the outstanding balance on your mortgage.

Loan term (years) - This is the length of the mortgage you're considering. For example, if you're buying a home, you might choose a mortgage loan that lasts 30 years, which is the most common, as it allows for lower monthly payments by stretching the repayment period out over three decades. On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years. This is another common mortgage term that allows the borrower to save money by paying less total interest. However, monthly payments are higher on 15-year mortgages than 30-year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers.

Interest rate - Estimate the interest rate on a new mortgage by checking Rezzy's mortgage rate tables for your area. Once you have a projected rate (your real-life rate may be different depending on your overall financial and credit picture), you can plug it into the calculator.

Loan start date - Select the month, day and year when your mortgage payments will start.