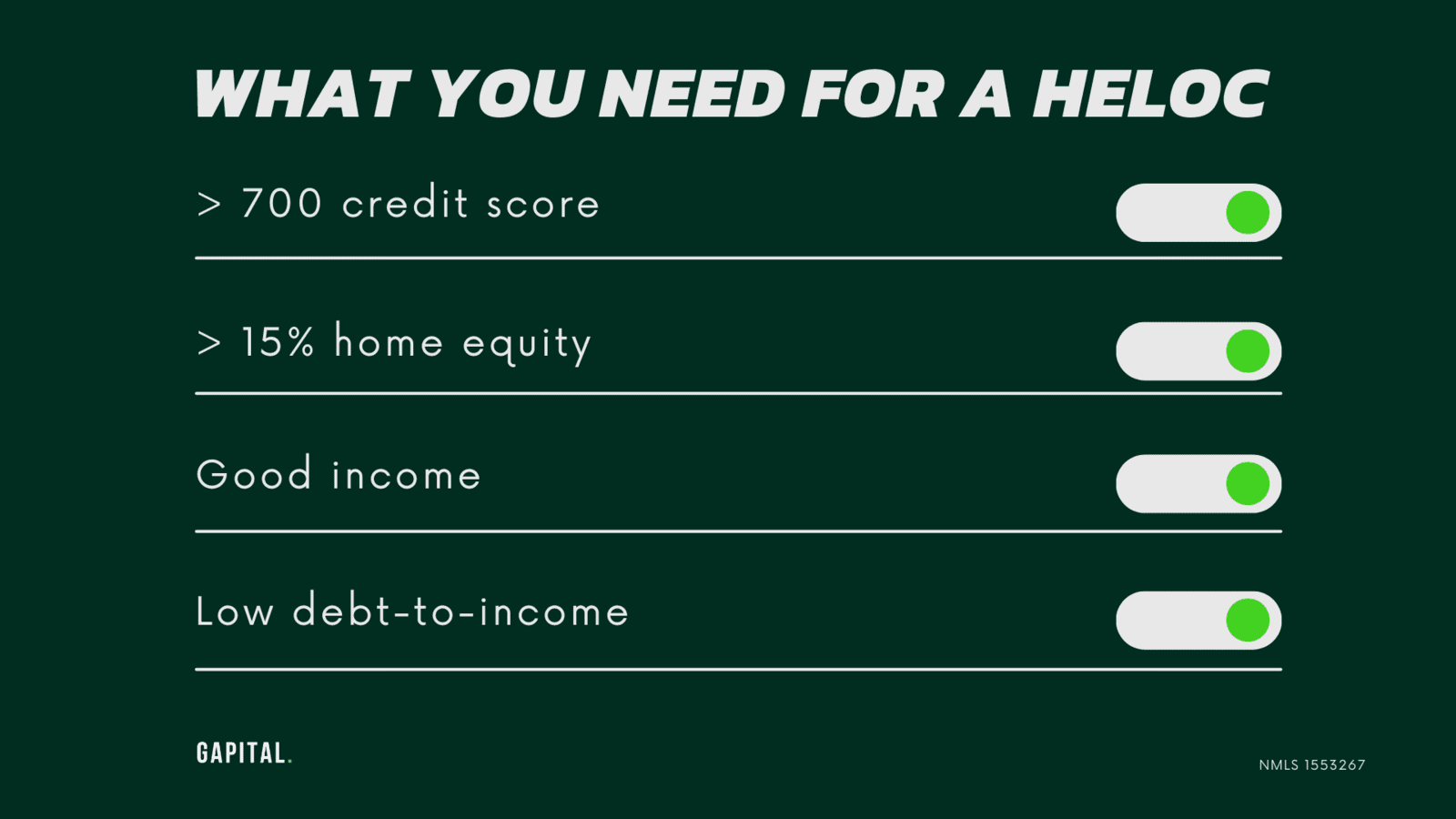

A home equity line of credit, or HELOC, is a type of home equity loan that allows homeowners to borrow money against the equity they have in their home and receive that money as a line of credit. Borrowers can use HELOC funds for a variety of purposes, including home improvements, education and the consolidation of high-interest credit card debt. HELOCs typically have lower interest rates than personal loans. You'll likely get a better rate if you have a high credit score, a low debt-to-income ratio and a lot of equity in your home.

Find out how much you can draw.

Let a Gapital Pro help you with the best refinance options.

How to Pay Back a HELOC

A HELOC has two phases that separate borrowing and repayment, also known as the draw period and the repayment period. Be aware, however, that you’ll make payments on the loan during both periods.

Phase 1: The Draw Period

Phase 2: The Repayment Period

Pros and Cons of HELOCs

HELOCs offer a combination of relatively low interest rates and the flexibility to borrow what you need when you need it. If you need money over a staggered period, a line of credit is ideal. However, there are always risks when you take out a loan, especially one that's secured by your home. Here are some of the key considerations for getting a HELOC.

PROS

- Typically lower upfront costs than with home equity loans.

- Lower interest rates than with credit cards.

- Usually low or no closing costs.

- Interest charged only on the amount of money you use.

PROS

- Lenders may require minimum draws.

- Interest rates can adjust upward or downward.

- Lenders may charge a variety of fees, including annual fees, application fees, cancellation fees or early closure fees.

- Late or missed payments can damage your credit and put your home at risk.

HELOC vs. Home Equity Loan

While HELOCs and home equity loans are similar in some ways, they have a few distinct differences. These are some of the key factors you should consider when deciding between a HELOC and a home equity loan.

| HELOCs | Home Equity Loans | |

|---|---|---|

| Interest Rates | Variable | Fixed |

| APRs | Slightly lower | Slightly higher |

| Disbursement | When needed | Lump sum |

| Repayment Terms | First 5-10 years: Interest-only payments Last 10-20 years: interest and principal | 10-30 years of fixed payments |

| Best for | Ongoing home improvement projects, college tuition payments, medical expenses | Debt consolidation, large home improvement projects, major purchases |

HELOC vs. Cash-out Refinance

A cash-out refinance replaces your current home mortgage with a larger home loan. The difference between the original mortgage and the new loan is disbursed to you in a lump sum. The main difference between a cash-out refinance and a HELOC is that a cash-out refinance requires you to replace your current mortgage, while a HELOC adds a loan to your current mortgage.

A HELOC may be a better option for you if:

- You want more flexibility.

- You already have a good mortgage rate.

- You plan to use your HELOC only for tax-deductible home improvement projects.

A cash-out refinance may be a better option for you if:

- You prefer a fixed monthly payment.

- You want a lower mortgage rate.

- You want to withdraw more home equity.

Apply for a HELOC.

A Gapital Pro will walk you through your options and help you make the best mortgage choice.